Corporate America has been on quite a run. Coming into 2021, S&P 500 Index companies were expected to generate less than $170 in earnings per share. As 2022 begins, it looks like that number may end up higher than the latest LPL Research estimate of $205, one of the biggest earnings upside surprises ever and a big reason why stocks did so well last year. But 2021 earnings are not yet fully in the books. We have one more quarter to go, which we preview here.

Big banks kick us off

Fourth quarter earnings season kicks off this week with earnings from several big financials, including BlackRock, Citigroup, JPMorgan Chase, and Wells Fargo reporting on Friday, January 14. This week just seven S&P 500 constituents report, but another 40 will announce results the following week (January 17-21) and 99 the week after that (January 24-28).

We welcome the shift from the macro to the micro where companies can continue to showcase their ability to effectively manage through the pandemic challenges, notably the supply chain disruptions and labor and materials shortages that are pushing costs higher.

What to expect

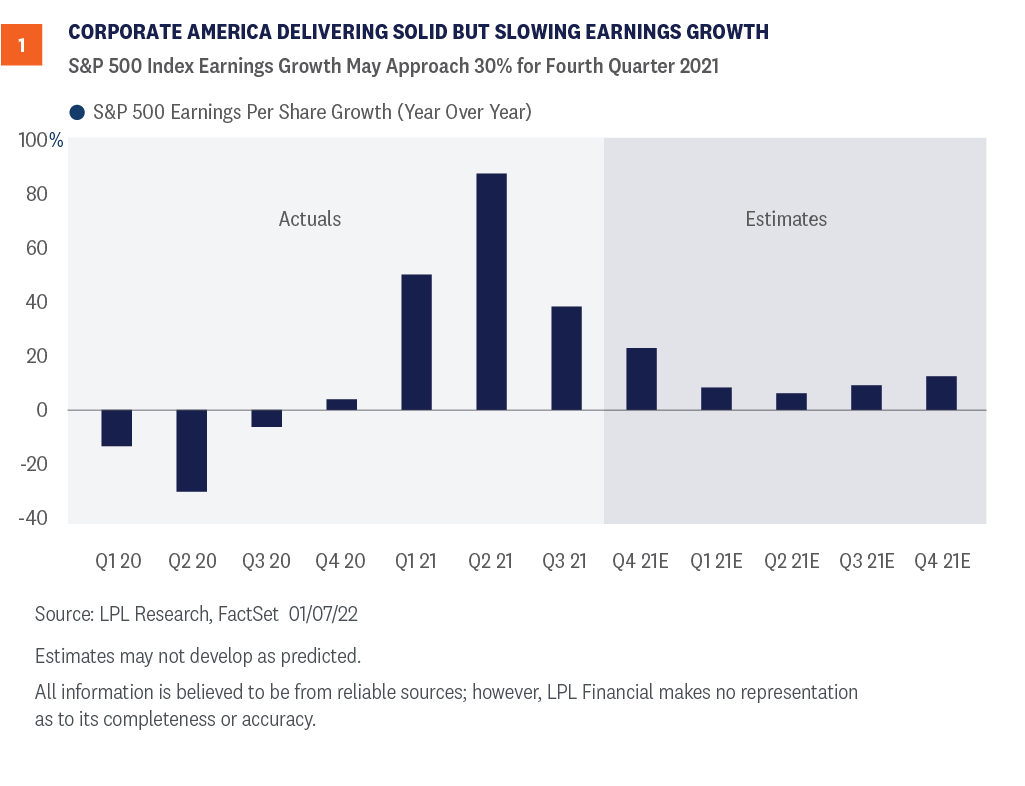

We expect another good earnings season overall in which companies continue to beat expectations in aggregate and produce solid growth. Consensus estimates are calling for a year-over-year increase in S&P 500 earnings in the fourth quarter of about 22% [Figure 1]. The long-term average upside surprise of around five percentage points makes 27% a reasonable target, but given earnings beat estimates by 12 percentage points last quarter, the number could be higher. Earnings growth approaching 30%, though slower than the third quarter’s nearly 40% clip, would be impressive given the challenging operating environment.

We see several reasons to remain optimistic for this earnings season. First, estimates have been rising. Since the end of October 2021, the consensus estimate for fourth quarter S&P 500 EPS has increased 3.3%.

Second, manufacturing activity has remained healthy based on purchasing managers’ surveys—the U.S. Institute for Supply Management (ISM) manufacturing index averaged a very strong 60.2 in the fourth quarter— in both the headline number and the new orders component. Additionally, in the December report there were signs of lower input prices and some easing of supply chain disruptions.

Third, we expect the COVID-19 Omicron variant to have limited impact on demand, i.e., revenue, in the quarter. The Bloomberg-tracked consensus forecast for gross domestic product (GDP) growth in the fourth quarter is 5.2% year over year. Add a consumer price index (CPI) increase of over 6% year over year and it’s easy to see how 12.7% revenue growth, the current consensus, is possible. Remember, higher prices end up as more revenue for someone, as higher costs are passed along to customers. That’s why equities have preserved their value through inflationary periods over time.

At the same time, there are some reasons to be concerned about less upside and more shortfalls. The Omicron variant did slow economic activity in December. And the ratio of negative pre-announcements to positives (1.7) has been more negative than the prior quarter’s ratio of 0.8, according to Refinitiv data.

What we’re watching

Margins, margins, margins. We will continue to watch for signs of pressure on profit margins from rising costs of labor, materials, and transportation. We came away from third quarter earnings season with the impression that most supply chain issues would be resolved by midyear. Any information contrary to that could influence the market’s response to results and direction of analysts’ earnings estimates for 2022.

Wages are key. Wages are the single biggest component of companies’ costs, so we will be looking for confidence from companies that wage pressures are manageable. We anticipate higher wages will soon start to eat into profit margins, as productivity gains from technology investments (i.e., doing more with less) can only go so far. We would like to see more workers enter the labor force to help contain wage increases, which are already running above 4% annualized.

Ability to pass on higher costs. We’ll also be interested to hear companies’ comments on the stickiness of price increases. If customers are starting to balk at higher prices, we may see some impact on demand and therefore revenue in coming quarters.

Earnings outlook for 2022

As we discussed in Outlook 2022: Passing the Baton, we expect a very favorable revenue environment in the coming year, with potential above-average economic growth and price increases. Revenue growth has historically been closely tied to nominal GDP growth (real “inflation–adjusted” GDP growth plus inflation). Our 4–4.5% real GDP growth forecast for next year, plus at least a few percentage points of inflation, puts 7% revenue growth in play, which is where consensus is currently.

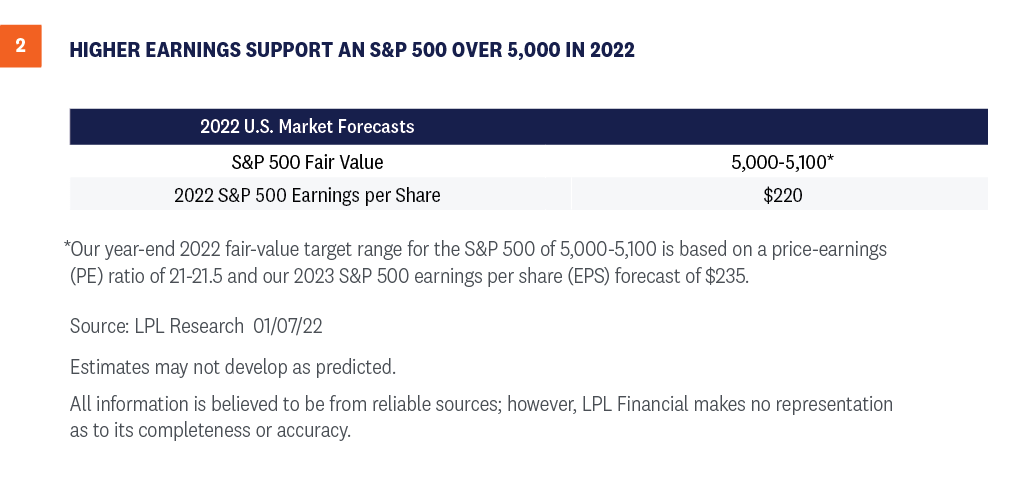

But margins are the tricky part. If they are stable—no small task—then a double-digit percentage increase in S&P 500 earnings per share (EPS) is possible. That would put S&P 500 EPS near $230 in 2022 and well above our current forecast of $220 [Figure 2].

But higher costs from COVID-19-related supply chain disruptions and materials and labor shortages are unfortunately not going away anytime soon. Wages are on the rise (average hourly earnings in Friday’s employment report rose 4.7% year over year, well above the 4.2% that was expected). And COVID-19 is still slowing economic activity. So, we prefer to be a bit more cautious for now and keep our S&P 500 EPS below-consensus forecast at $220, about 7% above our already conservative 2021 estimate of $205.

We believe a continued economic expansion in 2023 as the impacts of COVID-19 fade, along with only a small potential hit from tax increases, will get us to $235 in S&P 500 EPS next year. That assumes a scaled-down version of Build Back Better with some tax increases passes. If it doesn’t, which we see as less likely, there won’t be any tax drag, introducing some upside potential to earnings next year.

Look for 5,000 on the S&P 500 in 2022

Despite the Fed’s accelerated tightening timetable, we continue to believe the S&P 500 will reach 5,000 in 2022. Earnings will have to do the heavy lifting to get us there with valuations elevated, though we believe a price-to-earnings ratio (P/E) in the 21–22 range is fair even if interest rates move modestly higher—that gets us to 5,000+ by year-end 2022.

As the market continues to adjust to tighter monetary policy and factors in the still uncertain path of COVID-19, more volatility is likely. But that doesn’t change our enthusiasm for stocks here, especially relative to bonds, powered by solid earnings gains, the likelihood that COVID-19 risks fade as the year progresses, and our belief that inflation will be manageable in the latter part of this year.

Click here to download a PDF of this report.

______________________________________________________________________________________________

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

RES-1000900-0122 | For Public Use | Tracking # 1-05229974 (Exp. 1/23)